In-House vs. Outsourced Billing: 2026 Cost Comparison for Growing Practices

In 2026, many healthcare practices are earning more revenue yet struggling to improve their margins. The reason often lies in quietly rising billing costs. Salaries, software, training, claim rework, and delayed reimbursements add up over time, making billing one of the most expensive functions in a growing practice.

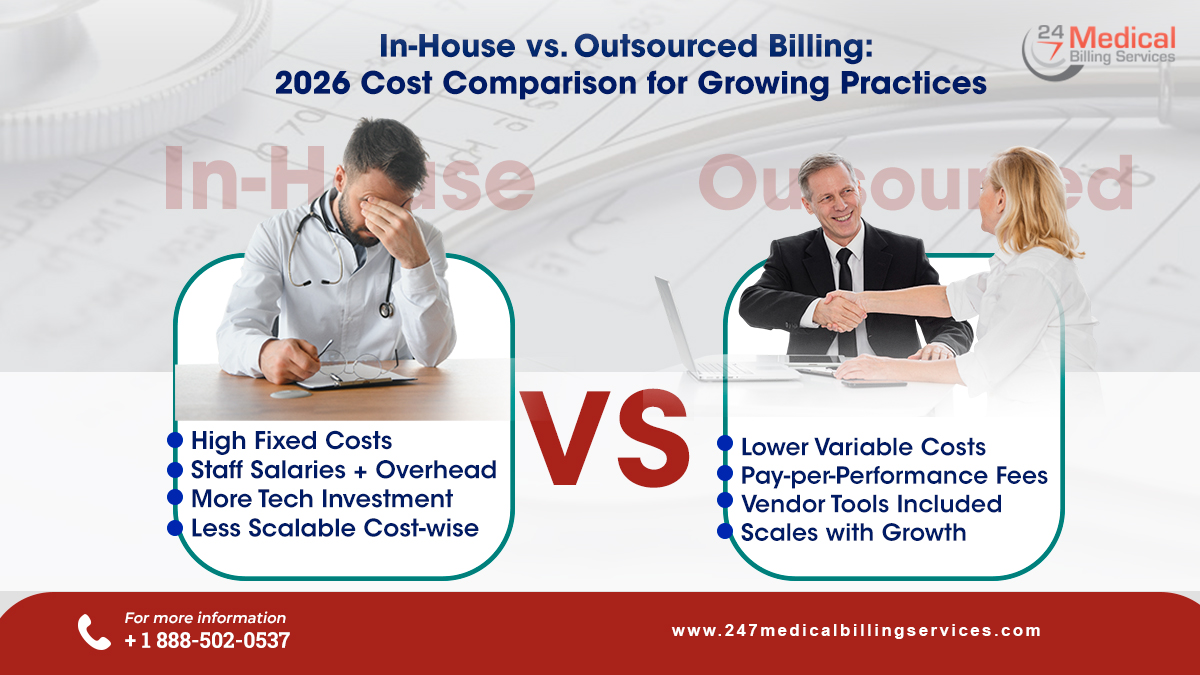

As financial pressure increases, practices are beginning to question whether managing billing in-house is still cost-effective or whether outsourcing offers better financial control. Keeping this in mind, the blog will compare the costs of in-house and outsourced billing and help practices identify which approach delivers better financial efficiency in 2026.

In-House vs. Outsourced Billing: What it Costs in 2026

As healthcare practices grow in 2026, billing costs increasingly influence profitability and cash flow. In fact, rising denial rates, workforce shortages, and complex payer requirements make billing decisions financially critical. This comparison focuses strictly on cost differences between in-house and outsourced billing, helping growing practices understand where expenses originate and how each model affects long-term financial sustainability.

-

Staffing & Labor Costs

In-house billing requires full-time billers, coders, and often supervisors. In 2026, salaries typically range from $55,000 to $75,000, whereas benefits and payroll taxes add 20–30%. Additionally, turnover rates approaching 40% increase recruitment costs, disrupt workflows, and reduce overall billing efficiency for growing practices.

Outsourced billing replaces fixed salaries with service-based fees, generally 5–8% of net collections. In fact, the healthcare practices avoid payroll, benefits, recruitment, and HR overhead. Furthermore, outsourced companies maintain staffing redundancy to ensure uninterrupted billing operations despite absences, turnover, or workload fluctuations without increasing internal administrative or financial burden.

-

Technology & Software Costs

Internal billing operations require dedicated billing software, EHR integrations, and IT support. It is important to note that annual licensing and maintenance costs commonly range from $12,000 to $60,000. Additionally, cybersecurity, system upgrades, and troubleshooting expenses increase as claim volume rises, contributing to ongoing operational overhead.

With outsourced medical billing, technology expenses are bundled into the service fee. In fact, outsourcing medical billing and coding service providers offer secure platforms, analytics tools, and reporting dashboards without upfront investment. As a result, practices gain access to modern billing technology while avoiding recurring software licensing, IT staffing, maintenance costs, and system upgrade responsibilities.

-

Training & Certification Costs

Billing regulations evolve frequently, requiring continuous training on ICD, CPT, and payer updates. As a result, practices typically spend $2,000–$5,000 per employee every two years on education and certifications. During training periods, productivity often declines, indirectly affecting claim accuracy, submission speed, and overall reimbursement performance.

Outsourced billing providers manage all training and certification requirements internally. Their teams receive continuous education to stay aligned with regulatory changes. Consequently, practices maintain consistent billing accuracy and compliance while eliminating recurring training expenses and avoiding productivity disruptions caused by staff education cycles.

-

Compliance & Regulatory Risk Costs

In-house billing places full compliance responsibility on the practice. However, limited internal bandwidth can increase exposure to documentation errors, audits, and penalties. As healthcare regulations tighten in 2026, managing HIPAA compliance and payer-specific rules internally often results in greater financial risk and administrative strain.

Outsourced billing companies maintain dedicated compliance and quality assurance teams. These teams continuously monitor regulatory updates and proactively adjust workflows. This significantly reduces audit exposure, minimizes compliance-related penalties, and protects practices from revenue disruptions caused by regulatory errors or outdated billing processes.

-

Claim Denial & Rework Costs

In-house billing teams typically experience denial rates between 12% and 18%. Each denied claim may cost $25–$100 in staff time for rework and follow-up. Due to limited capacity, many denials remain unresolved, leading to revenue leakage and lower overall collection efficiency.

Outsourced billing providers maintain lower denial rates, usually between 2% and 5%, through specialized coding expertise. Dedicated denial management teams track and appeal claims consistently. As a result, practices achieve higher first-pass acceptance rates and recover more revenue without increasing staffing costs.

-

Cash Flow & Accounts Receivable Costs

Practices handling billing internally often experience accounts receivable cycles of 50–60 days. As a result, delayed follow-ups and staffing limitations slow reimbursements. Therefore, reduced cash availability can strain working capital, limit operational flexibility, and restrict the practice’s ability to invest in growth initiatives.

Outsourced billing reduces accounts receivable cycles to approximately 30–40 days. In fact, faster claim submissions and consistent follow-ups accelerate reimbursements. This improves cash flow predictability, strengthens liquidity, and enables practices to manage expenses and growth plans with greater financial confidence.

-

Scalability & Growth Costs

As patient volume increases, in-house billing requires additional hiring, training, and software expansion. These costs rise in steps rather than gradually, making growth expensive and challenging to manage. Seasonal spikes or rapid expansion often lead to overtime expenses and higher error rates.

Outsourced billing scales seamlessly with collections. As costs adjust based on performance, practices avoid sudden staffing or infrastructure investments. This flexibility supports growth while maintaining cost efficiency and prevents billing operations from becoming a financial bottleneck during expansion phases.

-

Total Cost Impact in 2026

When fully calculated, in-house billing typically costs 6–7% of collections, excluding indirect losses from denials and delayed payments. These fixed costs remain constant regardless of billing performance, placing increasing pressure on margins as practices grow and administrative demands increase.

Outsourced billing generally costs 5–8% of collections and includes staffing, technology, compliance, and denial management. In fact, many growing practices report overall cost savings of 40–60% by converting fixed overhead into predictable, performance-based billing expenses aligned with revenue.

Which Medical Billing Model Makes Sense in 2026?

As healthcare practices enter 2026, the decision between in-house and outsourced billing is a strategic financial decision. Though in-house billing may provide a sense of control and immediate visibility, it also demands ongoing investment in staffing, technology, training, and compliance. In fact, these fixed costs can limit flexibility and place growing pressure on practice margins.

On the other hand, outsourced medical billing and coding offers a more adaptable and cost-efficient model. In fact, shifting to performance-based pricing reduces overhead, improves claim accuracy, and accelerates reimbursements, all while minimizing exposure to staffing shortages and regulatory risk. This approach allows practices to align billing costs directly with revenue performance rather than absorbing unpredictable administrative expenses.

Furthermore, partnering with established providers such as 24/7 Medical Billing Services gives practices access to certified specialists, advanced billing infrastructure, and continuous claim oversight without placing additional strain on internal resources. As billing complexity continues to increase, outsourcing enables practices to remain financially stable, operationally efficient, and focused on patient care. This makes outsourced medical billing the preferred choice for sustainable growth in 2026.

FAQs

Which billing model is easier to budget for in 2026?

Outsourced billing is easier to budget because costs scale with collections rather than remaining fixed.

Is in-house billing more expensive during low patient volumes?

Fixed staffing and software costs remain the same even when collections decline.

Is outsourcing billing a short-term or long-term cost strategy?

Outsourcing is typically a long-term strategy for maintaining sustainable billing costs.

Which billing model aligns better with growth-focused practices in 2026?

Outsourced billing aligns better with growth due to scalable, performance-based cost structures.

.png)